|

|

|

|

|

|

|

|

|

|

|||

|

|

|||

|

|

|||

|

|

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

|||

|

|

|||

|

|

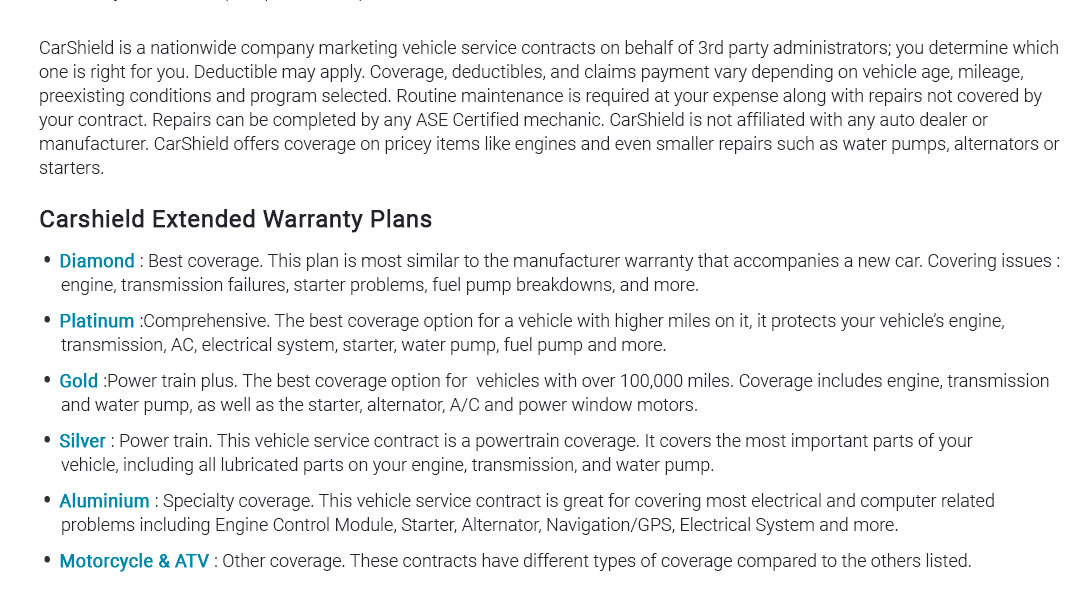

Understanding the Cost of Auto Extended Warranties: An In-Depth LookWhen it comes to purchasing a vehicle, whether brand new or pre-owned, the decision-making process is often accompanied by a multitude of considerations, one of which is the potential acquisition of an auto extended warranty. These warranties, which offer coverage beyond the standard manufacturer warranty, can provide peace of mind to vehicle owners by covering repairs and maintenance once the original warranty expires. However, the cost associated with these warranties can vary significantly, influenced by a range of factors. This article aims to demystify the costs involved and help consumers make informed decisions. Factors Influencing the Cost The price of an auto extended warranty is not a one-size-fits-all figure. Rather, it is contingent on several variables, each playing a pivotal role in determining the final cost. One major factor is the make and model of the vehicle. Luxury and high-end brands often attract higher warranty costs due to the expensive nature of their parts and the specialized labor required for repairs. In contrast, more economical models may benefit from lower premium rates. Another crucial element is the age and mileage of the car at the time of warranty purchase. Generally, newer vehicles with lower mileage are less expensive to cover, as they are perceived to be at a lower risk of requiring repairs in the near future. This perception shifts as the vehicle ages and accrues more miles, thus increasing the cost of the warranty. Levels of Coverage The extent of coverage desired also plays a significant role in determining the cost of an extended warranty. Basic plans that cover only major mechanical components tend to be less expensive. However, comprehensive plans that include electrical systems, advanced technology features, and roadside assistance come at a premium. It's essential for consumers to assess their individual needs and the likelihood of specific repairs when selecting a coverage plan. Provider Reputation and Policy Terms The reputation of the warranty provider and the terms of the policy itself can also influence pricing. Established providers with a solid track record may charge more due to their reliability and proven service quality. Additionally, longer-term policies often incur higher costs upfront, though they may offer more value over time by providing extended protection. Is It Worth It? The debate over whether auto extended warranties are worth the investment is ongoing. Proponents argue that they offer financial protection against unexpected repair costs, potentially saving owners thousands of dollars. Critics, however, point out that many owners never use the full extent of their coverage, rendering the initial expense unnecessary. Ultimately, the decision hinges on personal circumstances, including the vehicle's reliability, the owner's financial situation, and their appetite for risk.

In conclusion, the cost of an auto extended warranty is a multifaceted issue influenced by numerous factors. While they can offer substantial benefits, it is crucial for consumers to conduct thorough research and reflect on their individual needs before making a purchase. By doing so, vehicle owners can ensure they are getting the most value from their investment, safeguarding their automotive future. https://www.marketwatch.com/insurance-services/car-warranty/best-extended-car-warranty/

The average total cost of the best extended car warranty plans costs anywhere between $1,500 and $4,000, but your cost will be based on several ... https://www.creditkarma.com/auto/i/extended-car-warranty

The upfront cost of the warranty can range from $1,000 to $3,000 or more. Plus, if you roll the cost of the warranty into your auto loan, you'll ... https://wallethub.com/edu/ci/extended-car-warranties/94320

An extended car warranty costs around $1,500 on average, with prices typically ranging between $1,000 and $3,000. The exact cost of an extended ...

|